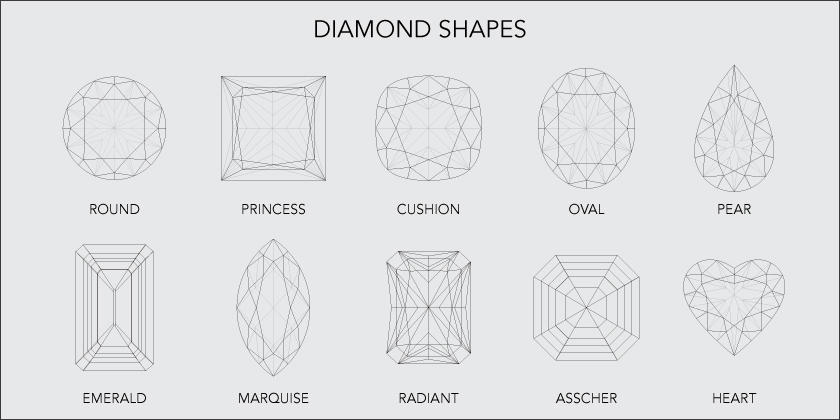

Many diamond shapes go in and out of style with the ever-changing trends. So, what do you do when your diamond needs a cut upgrade? One of the more recent cuts to lose popularity is the marquise. The classic, antique look of the marquise is currently rumored to look old-fashioned by many. However, there are still some who appreciate the cut as elegant and vintage.

How shapes affect the value

Although you may not think of popularity having a great affect on the resale value of diamonds, many jewelry retailers have to take this into consideration when evaluating. If you are looking to sell or use your diamond for an asset-based loan, the lender you work with may have to deduct value for an outdated cut. This is because the buyer or lender has to consider the cost associated for re-cutting a diamond into a more popular shape. Our expert staff at Diamond Banc can evaluate your diamond to get you the best price for your diamond, as well as explain the market trend for your current cut.

When re-cutting diamonds, a jeweler does not want to remove an excessive amount to achieve a more desirable cut. Otherwise, the diamond could lose value from the decreased carat weight. This is why marquise diamonds are commonly cut into pears or ovals.

Why re-cutting increases value

Some jewelers also find that re-cutting a diamond may remove inclusions. For example, if a marquise has a feather, crystal, or other blemish in one of the points, cutting off one or both points would increase the diamond’s quality. If the decrease of inclusions is significant, a jeweler may even send a diamond to be graded again by a gemological lab to increase its value.

If you are thinking about selling your diamond, it is important to know all the factors that go into a jeweler’s evaluation. Even if you would rather use your diamond as collateral for an asset-based loan, jewelers must consider the same factors to protect their investments. If you are curious about the value of your diamond and its cut, fill out our no-obligation Sell Your Diamond form or Asset-Based Loan form. You can also visit us at one of our five locations nation-wide:

- Boca Raton, FL

- Columbia, MO

- Kansas City, MO

- Miami, FL

- Nashville, TN

- Orlando, FL

- Palm Beach, FL

- Roswell, GA

- Tampa, FL