Frequently Asked Questions

Meet The Team: National Buying & Lending Division

How It Works: Redeeming Your Loan

How To Turn Your Jewelry Into A Working Asset

Your Diamond Is Worth MORE To Diamond Banc

Your Fine Jewelry Deserves Better – Avoid The Pawn Shop

A Far Superior Way To Borrow Against Your Fine Jewelry

How It Works: Selling Your Rolex to Diamond Banc

What Can Diamond Banc Do for Jewelers?

How Do We Determine Our Loan Costs?

How Are Our Loan Values Determined?

Why is Diamond Banc the Best Jewelry Asset Loan Provider in the Nation?

How Do We Determine the Liquid Value of Your Diamond?

What Liquidity Options Are Available with Diamond Banc?

What Is the Difference Between the Retail Appraisal Value and the Liquid Value?

Inside Look: Our Secure Mail-In Headquarters

How It Works: Sell Your Jewelry or Get A Loan Online

Jewelry Equity Loans – An Underutilized Financial Tool

3 Ways To Maximize The Return On Your Diamond

What Makes Us The Nation’s #1 Diamond Buyer?

What Are the Benefits of a Jewelry Equity Loan From Diamond Banc?

Your Rolex is Worth More to Diamond Banc

How Does Shape Impact A Diamond’s Value?

How Much Is a Pre-Owned Engagement Setting Worth?

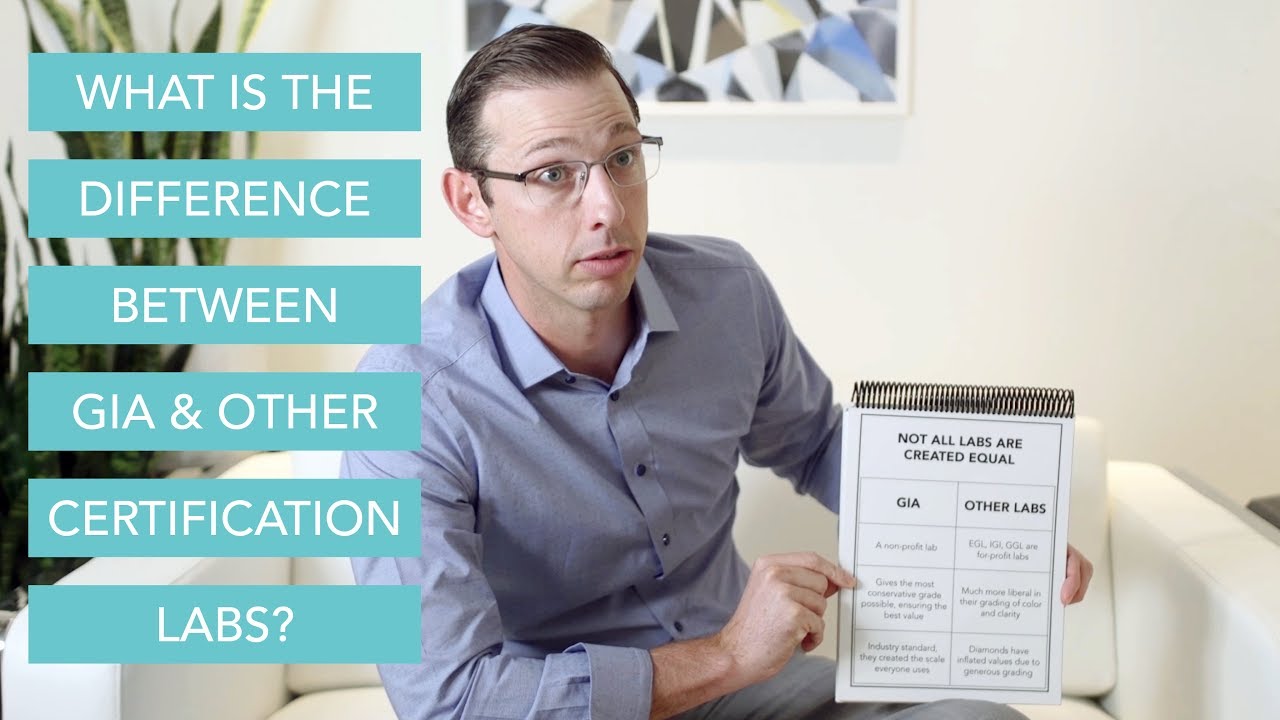

What Is the Difference Between GIA and Other Certification Labs?

What Determines the Liquid Value of Pre-Owned Designer Jewelry?

Why Shouldn’t I Sell My Jewelry on an Auction or Consignment Site?

How Are Our Jewelry Equity Loans Structured?

What Is Our VIP Seller’s Agent Service?

Diamond Banc accepts several types of personal assets as collateral for a loan; including, Diamonds, Fine Jewelry, Luxury Watches, Gold & Precious Metals.

Have something else to offer? Diamond Banc is open-minded and entrepreneurial. We have provided loans on other types of assets as well, ranging from rare coins to high-end designer handbags. Contact us with the details of your item and we will do everything we can to assist you.

Our typical LTV (loan-to-value) ratio is 65% – 75% of the estimated liquid wholesale value of your asset. For example, say you purchased a diamond from a competitively priced retail store for $6,000. The wholesale value would likely be somewhere in the area of $4,500. We would then loan 75% of that value, meaning your loan amount would be approximately $3,375.

Diamond Banc does not conduct credit checks or employment verification on loans under $30,000. For loans $30,000 and greater, a simple background and credit check to ensure no pending insolvency. Diamond Banc does not report to any credit agencies and our loans are 100% private. In the event the borrower elects not to repay their loan, there is no negative recourse to the borrower outside of surrendering ownership of the pledged collateral.

All assets are stored on-site in one of our state-of-the-art, alarm-protected, 24-hour security monitored, fireproof vaults. Your items are also fully insured for their full replacement value while in our custody.

Your minimum monthly loan payment will consist of interest, security, storage, and insurance fees. This amount will depend on the total amount borrowed as well as the type and value of the asset used as collateral, with rates as low as 2.5%.

Diamond Banc offers 30-day loans that can be extended for as many 30 day periods as the client needs. There is no minimum loan period, as our loans can be paid off in full at any time without penalty. What sets us apart from many of our competitors is the option to pay the loan down in increments as opposed to one lump sum payment. Any amount paid each month above the “monthly rate” will go towards reducing the principal balance therefore reducing your minimum monthly payment. This means our clients can take as little or as long as they need to repay the loan. You have the freedom to structure your monthly payments in any way that best fits your needs and financial situation.