Fast. Simple. Secure.

Diamond Buyers

The Nation's Premier Diamond Buyer

Kyle Z. Cook

National Headquarters | Columbia, MO

Contact information & biography expand_more

Jordan Isaacs

National Headquarters | Sarasota, FL

Contact information & biography expand_more

Get A Quote

What is your item worth?

Complete our simple online submission form & tell us about your item. Our team of experts will contact you with an initial quote.

Start a QuoteExpert Evaluation

Mail-In or In Person

We provide you with a fully insured shipping label to send your items to our headquarters for final evaluation. Or, visit a Diamond Banc office near you to complete your transaction in person.

Get Funded

Via Check or Wire Transfer

If you accept our offer, we will issue payment immediately via check or wire transfer.

FAQs

How does selling my diamond work?

There are two ways you can sell your diamond to Diamond Banc:

- Fill out our online submission form above & receive a quote within 24 hours from one of our expert diamond buyers. Our team will provide you with a fully-insured shipping label to mail your diamond to our headquarters. From the moment your diamond arrives at our headquarters, it remains on continuous video surveillance until the package is opened and your items are verified. If you accept our offer, payment will be issued immediately via wire transfer. If you elect not to accept our offer, your diamond is expedited back to you with a fully-insured shipping label.

- Visit a Diamond Banc office near you. If you are looking to receive an immediate offer & same-day funding, we encourage you to visit one of our offices nationwide. Schedule an appointment at a Diamond Banc location near you, have your jewelry evaluated on the spot, and get paid immediately. Typically, this process takes less than 40 minutes.

Is it safe to ship my diamond?

Yes. Your items are fully insured for their full replacement value while in transit and while in our possession. We provide you with a fully insured shipping label to send your diamond to our headquarters. Our shipping and logistics team tracks your package every step of the way. From the moment your diamond arrives at our headquarters, it remains on continuous video surveillance until the package is opened and your items are verified.

Do you purchase diamonds without a certification?

Yes. We purchase natural diamonds with and without a diamond certification.

What makes Diamond Banc the nations #1 diamond buyer?

Clients love working with Diamond Banc based on the transparency and guidance that we deliver.

We show you wholesale comparable diamonds to yours, what dealers are asking for them, and what dealers are selling them for and we show you this on the largest dealer-to-dealer trading platform in the world. We explain why we’re making the offer that we’re making, and allow you to understand that you’re truly getting the most they can for your diamond.

Our ultimate goal is to ensure you feel confident in your decision to sell your diamond by providing you with the transparent diamond education you deserve.

How do I get paid for my diamond?

Once you accept our purchase offer, we issue payment via check or wire transfer immediately.

From Our Founder

What Clients Are Saying

See all Google ReviewsFeatured in

Start Online or Visit An Office Near You

OUR LOCATIONS

Miami, FL • Aventura, FL • Boca Raton, FL • West Palm Beach, FL • Sarasota, FL • Tampa, FL • Orlando, FL • Atlanta, GA • Nashville, TN • Columbia, MO • Kansas City, MO • St. Louis, MO • Scottsdale, AZ

In some cases, a diamond isn’t forever. Whether you’re looking to sell jewelry that you inherited, upgrade your jewelry, let go of an engagement ring from a previous relationship, or seek the resale of diamond jewelry, there are countless reasons you might be looking to sell a diamond. Unfortunately, unlike most diamonds, clarity is not an attribute that the jewelry resale market is known for. There are countless factors to consider when you’re looking to sell your diamond.

Here, we are breaking down some of the most frequently asked questions and providing advice to make sure that you get the most for your diamond jewelry.

The factors that will determine the value of your diamond to a diamond buyer

Understanding the worth of a diamond can be confusing, particularly when considering the various factors involved in reselling your diamond to a buyer. Similar to any item, the current value of your diamond is determined by the classic supply and demand equation and how it applies to a diamond like yours in the current market. A diamond’s rarity indicates that diamonds with the same or similar attributes are currently not available in the market in large quantities, but rarity does not speak to demand. Demand is the more crucial factor in determining the current liquid value of your diamond. The term “demand” refers to the number of potential buyers in the market who are willing to pay for a diamond like yours.

Just because a diamond type is rare in quantity does not automatically mean it is in demand. In fact, it could mean the opposite. New diamonds cut from mined diamond rough are manufactured into the diamond shapes and sizes that the market demands the most at the time of production. While round brilliant diamonds have historically been in high demand from a shape perspective, other diamond shapes experience peaks and valleys in demand, much like clothing styles.

When selling diamonds to end consumers, the jewelry industry often portrays higher quality diamonds (i.e., those closer to colorless and flawless) as rarer and more valuable. The universal truth, however, is that higher-quality diamonds are simply less available than average-grade diamonds. What determines the salability of any type is the current consumer demand in relation to the supply available. If there are 200 diamonds like yours in the market and 250 buyers, the resale value of your diamond will be optimal. If there are 50 diamonds like yours for sale in the market, but only 20 active buyers, then the willing buyers are rarer than the diamond

In the United States, most women want the biggest and prettiest diamond in the buyers’ budget, not necessarily the rarest. This means that diamonds with higher color and clarity grades (i.e., rarer) typically take longer to sell from both dealers’ and retailers’ inventory. The longer it takes to sell an item, the larger the profit margin sellers try to achieve to compensate for tying up their money for a longer period. This often results in a larger buy/sell difference on rarer diamonds than on average ones that are still of high quality and beauty.

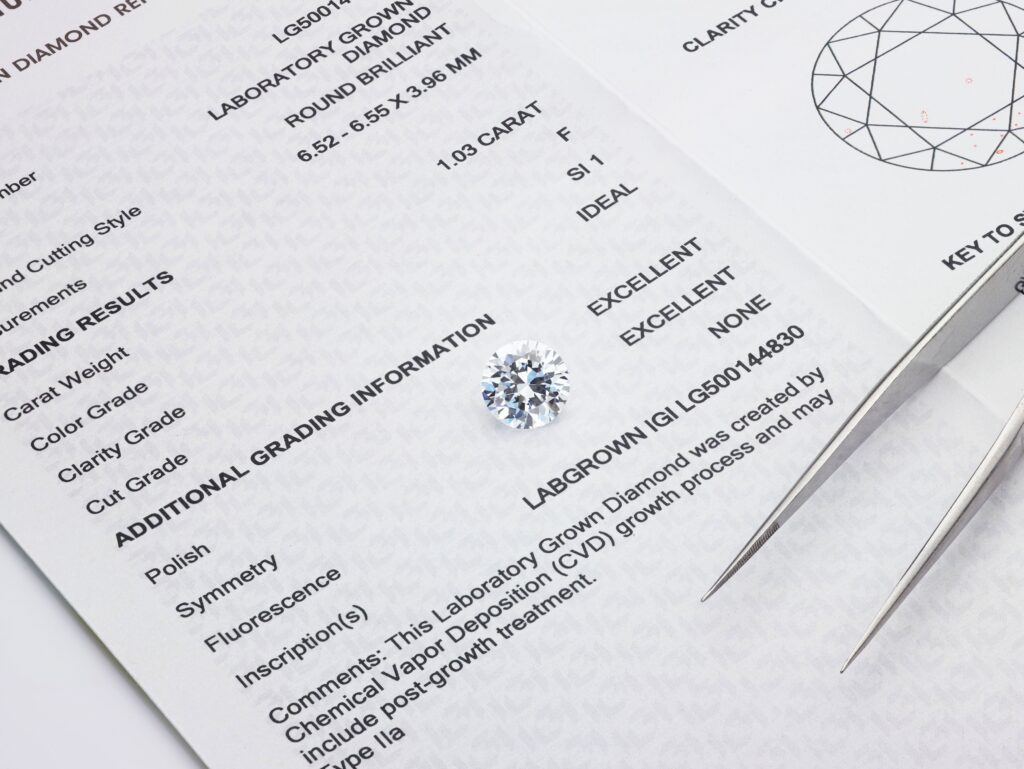

Are Certified Diamonds Worth MORE?

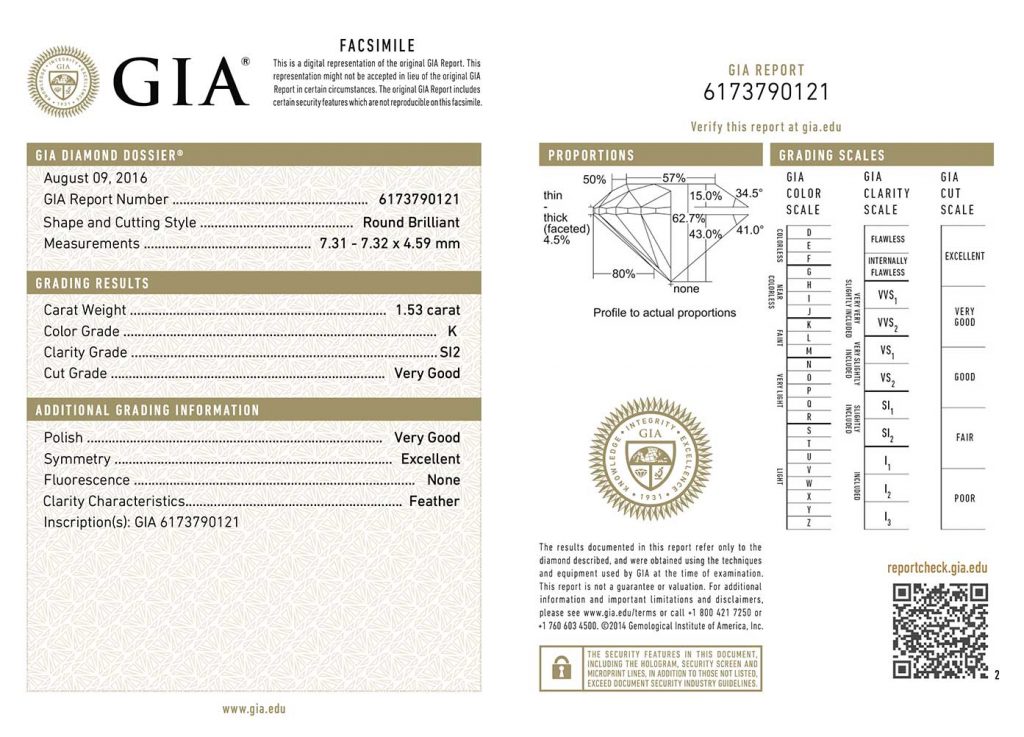

In essence, a diamond certificate acts as a blueprint of your diamond, providing essential information that can substantiate its value. While the inherent qualities of the diamond—its cut, clarity, color, and carat—are the primary determinants of its value, the certificate plays a crucial role in verifying these qualities to potential diamond buyers, thereby enhancing its attractiveness and saleability in the market.

A diamond certificate, often issued by reputable gemological laboratories like the GIA (Gemological Institute of America), AGS (American Gem Society), or EGL (European Gemological Laboratory), provides an unbiased analysis of the diamond’s characteristics, including its cut, color, clarity, and carat weight—commonly referred to as the 4Cs.

The GIA’s grading process is known for its strictness and consistency, providing a high level of trust and confidence in the diamond industry. Diamonds graded by the GIA come with certificates that are considered the gold standard in the industry, often influencing the diamond’s value and saleability. For buyers and sellers alike, a GIA certificate is a symbol of assurance and integrity, indicating that the diamond has been thoroughly examined by experts using state-of-the-art technology and methodologies.

Can I Sell An Uncertified Diamond?

Selling a diamond that lacks certification necessitates extra diligence in selecting a buyer. It’s imperative to engage with buyers known for their integrity and openness about their evaluation process. Steer clear of any buyers willing to buy your diamond without inquiring into the diamond’s specific qualities. Although presenting a diamond with a certificate is preferable, selling an uncertified diamond is possible!

Diamond Banc is a preferred diamond buyer by clients nationwide, purchasing both certified and uncertified diamonds. Our approach is rooted in a deep understanding of the diamond market and a commitment to transparency and fairness. By leveraging our expertise, Diamond Banc offers a seamless and trustworthy process for sellers, ensuring that every diamond—certified or not—is evaluated accurately. Our reputation for fairness and proficiency makes us an ideal partner for those looking to sell their diamonds, offering peace of mind and the assurance of a fair evaluation, irrespective of certification.

How my diamond attributes affect its value to a diamond buyer:

Cut Grade: Cut refers to the proportions of a diamond – not the shape. Cut grades specifically refer to the angles and measurements of a diamond. When all of these factors are ideal, the diamond will reflect light more efficiently, thus resulting in more brilliance to the naked eye. In most cases, cut is man’s only contribution to the diamond’s beauty.

Not all diamonds can be equally evaluated by diamond buyers on the basis of their cut. The only shape of diamond that has universally agreed upon cutting standards is the round brilliant shape diamond. The GIA cut grades go from Excellent, to Very Good, to Good, to Fair, to Poor. Diamonds with a cut grade of Good or below are notably less valuable than diamonds with a better cut grade. The cut grade alone can affect a diamond’s value by 25% or more.

All other diamond shapes such as the oval, princess, radiant, etc, have preferred dimensions and length-to-width ratios. The precision of your diamond’s cut in relation to these industry benchmarks affects its value. Diamond cutters’ primary concern is maximizing the carat weight they can produce when cutting a rough diamond. This focus on carat weight yield often produces diamonds that do not fall within industry-preferred standards.

Shape: Many people assume that cut refers to the shape of a diamond, however, this is inaccurate. Cut refers to the proportions of a diamond while shape refers to the general makeup of the diamond. Although the shape is not part of the 4 Cs, it does have a strong influence on a diamond’s value. Simply put, diamond buyers may more aggressively for shapes that are currently in demand from consumers.

Since the liquid value of a diamond is based on current market demand set by diamond ring buyers, after carat weight, the diamond’s shape has the most influence on its value. As jewelry trends evolve, the market demand for particular shapes shifts with it.

Since the liquid value of a diamond is based on current market demand set by diamond ring buyers, after carat weight, the diamond’s shape has the most influence on its value. As jewelry trends evolve, the market demand for particular shapes shifts with it. Consequently, this means that more classic styles tend to be worth the most on the secondary market. Round diamonds have the best value retention due to the consistent demand for this timeless style. In contrast, other shapes of the same size and quality may be worth considerably less due to current consumer preferences.

Since demand for these shapes fluctuates, much like fashion, the market can be much less reliable. For example, princess-shaped diamonds have fallen out of favor, creating far more supply than demand. These rapidly changing shifts also mean that there can be some distinctive discrepancies between the diamond appraisal value and the actual worth of the diamond you’re trying to sell since many appraisals do not take shape into account.

Carat Weight: The carat weight of a diamond is the most crucial aspect of the 4 Cs in determining its value. It is also the most significant value-adding factor. As the term “Carat Weight” suggests, carats are measured in weight, not in overall surface area. This means that some diamonds can be deeper or shallower than others. As a result, diamonds with identical carat weights may appear larger or smaller.

A diamond’s shape, also known as its “make” in the diamond industry, plays a crucial role in its appearance and value. Some diamond shapes, such as pears and ovals, can look significantly larger than more shallow diamonds of the same weight. Similar to how two individuals who weigh the same can vary dramatically in size, diamonds can vary in dimensions despite having the same carat weight.

While carat weight significantly affects the value of a diamond for all diamond and jewelry buyers, it does not indicate the diamond’s quality. However, it does not affect the value proportionately. As bigger diamonds are rarer than smaller diamonds, an increase in size tends to exponentially increase a diamond’s value. If all other factors – cut, color, and clarity – are equal, a one-carat diamond is not twice the cost of a half-carat diamond. It is approximately four times as valuable. A general rule is that larger diamonds that are well-cut and have a nice make historically enjoy an active audience of buyers.

Cut Grade: The cut of a diamond refers to its proportions – not its shape. Cut grades specifically refer to the angles and measurements of a diamond. When all of these factors are ideal, the diamond will reflect light more efficiently, resulting in more brilliance to the naked eye. In most cases, cut is the only contribution made by humans to a diamond’s beauty.

A diamond’s shape can play an important role in the appearance of certain carat weights in terms of size. Some sizes, like pears and ovals, can look significantly larger than more shallow diamonds of equal weight. Similar to how two individuals who weigh the same can vary dramatically in size, diamonds can vary in dimensions despite having the same carat weight.

While carat weight does significantly affect the value of a diamond for all diamond jewelry buyers, it does not indicate a diamond’s quality. Nevertheless, it does not affect the value proportionately. Because bigger diamonds are rarer than smaller diamonds, an increase in size tends to exponentially increase a diamond’s value. If all other factors are equal – cut, color, and clarity – a one-carat diamond is not twice the cost of a half-carat diamond. It is approximately four times as valuable.

Color Grade: Traditionally, the ideal diamond is white, however, very few diamonds have a pure white hue. A diamond’s color refers to its natural warmth. This warmth can be seen in the color a diamond casts. Diamonds can range from colorless to intense warmth. A color scale reflects these two polarities, or if a diamond falls somewhere in between. Diamonds with a color grade of “L” or below trade at significantly larger discounts, as buyers as a whole, are less interested in diamonds that appear discolored.

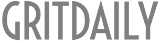

It should be noted that fancy-colored diamonds can exist outside of the context of the white diamond. These diamonds are measured on color intensity scales outside of the traditional GIA color grade system. Typically, the more intense a fancy color is, like a canary yellow diamond, the higher its value on the secondary market.

Color Treatments: There are a number of manmade procedures that can be used to achieve the ideal white color or to intensify the vibrance of an already colorful diamond. Color treatments like HPHT (High-Pressure High Temperature), can improve a diamond’s color or transform its color from a low-color diamond to a more desirable color, such as blue, green, or yellow.

Color treatments do not improve the rarity of your diamond. Consequently, they have a notable negative effect on the secondary value of your diamond. Many diamond buyers will decline to even make an offer on diamonds that have been color-treated. However, if you have a color-treated diamond over 1ct in weight, Diamond Banc is happy to evaluate it to potentially purchase it!

Clarity: A clarity grade categorizes the amount and type of internal characteristics found within a diamond. As a diamond forms, foreign elements may build up within its structure. These elements, called inclusions, form something like a birthmark for diamonds and will appear as dark specs within a gemstone.

| GIA Laboratory | All Other Laboratories |

|---|---|

| Non-profit, undisputed industry leader in diamond evaluation. | For-profit, with evaluations often open for debate and question. |

| Gives the most conservative and accurate grades. | Liberal evaluations that benefit the initial seller (retailer). |

| Industry leading technology and practices to ensure accurate grading and assessment. | Competency, accuracy, and evaluation metrics wildly vary. |

| Undisputed industry golden standard. | Diamonds have inflated retail values due to generous/liberal grading. |

Clarity grades range from “Flawless” to “I3” for included. Diamonds with clarity grades of SI1 to I1 are generally the most commercially desirable. The inclusions in these clarity grades are typically subtle enough that they cannot be noticed by the naked eye. However, since they are less than “perfect”, it will also lower the price of a diamond so a potential buyer can spend more money for the carat weight. Diamonds with high clarity grades, such as VVS2 and Flawless, often sell for a greater discount in relation to their original purchase price when being sold back to a diamond dealer for immediate payment, compared to sellers in the SI1 to I1 range, it can be more challenging for a diamond buyer to resell “perfect” or near-perfect diamonds since high-clarity diamonds tend to have a lower market demand than slightly less perfect diamonds. The demand for flawless diamonds is lower than other alternatives within the market, it can be more complicated to sell flawless or near-flawless diamonds for an attractive price.

The best way to ensure maximum return on high-quality diamonds is to deploy a longer selling horizon and sell them on consignment. This approach allows the consigner to find the end consumer who will appreciate and pay a premium for your diamond. Diamond Banc offers an effective consignment program that produces industry-leading proceeds for our clients when they wish to sell a large and rare diamond. We are even happy to provide a portion of the anticipated sale proceeds interest-free during the selling period. Learn more about the different options Diamond Banc offers clients to maximize the value of their important diamonds here.

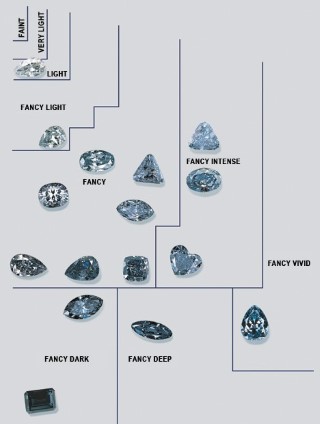

Are there Lab Grown Diamond Buyers?

NO. Most diamond buyers who purchase diamonds from the public typically do not buy lab-grown diamonds. Like most new technologies, the cost to produce lab-grown diamonds has fallen dramatically over time, while the quality and speed of production increases at a rapid rate. Think about the cost reductions and viability of smartphones and flat-screen TVs over time. The quantity available and usage explode while the cost of the items becomes cheaper and cheaper. The same principles hold true for lab-grown diamonds.

It’s hard to wrap your mind around the fact that lab-grown diamonds possess no rarity, which is the exact opposite of natural diamonds. With natural diamonds, the larger the diamond, the rarer and more valuable it becomes. With lab-grown diamonds, production has been improving so much that the cost difference to produce a 3-carat lab-grown diamond or a 1-carat lab-grown diamond is not material. There is no rarity involved. These factors are the reason why lab-grown diamonds have been steadily decreasing in price since they hit the marketplace. That means people are paying a lot less for a 2-carat lab-grown diamond at a retail jeweler today than they did for that same item a few years ago. This trend also means that the wholesale cost of lab-grown diamonds keeps dropping fast. Diamond buyers can already buy lab-grown diamonds for very little wholesale. Additionally, the lab-grown diamond they buy from you today will most likely be worth less in the short order, hence the reason diamond buyers generally do not buy lab-grown diamonds from the public.

Clarity Treatments: There are numerous treatments that people can apply to diamonds to improve their visual appearance, including fracture filling and laser drilling. Much like color enhancements, these treatments have a detrimental effect on the recycled diamond market value. Many diamond buyers will not buy enhanced diamonds of any type regardless of their carat weight or grades. Diamond Banc is always happy to assess treated diamonds to potentially provide a purchase offer.

Fluorescence: A diamond may be exposed to ultraviolet light during its formation. This can cause the diamond to emit visible light called fluorescence. This phenomenon is natural. In most diamonds, fluorescence is presented as blue light emission, although other colors of fluorescence exist. Many diamonds exhibit no fluorescence at all. When the GIA grades fluorescence in a diamond, the graders specifically focus on the intensity of detectable fluorescence.

Fluorescence rarely has a negative effect on a diamond’s beauty but can have a significant negative effect on its value. Generally, fluorescence begins to negatively affect a diamond’s value if the diamond has an “I” color grade or higher. As color and clarity improve, typically above an I in color and SI2 in clarity, the fluorescence has a more pronounced negative effect on a diamond’s value. The more notable the presence and strength of fluorescence in G color+ and VS2 clarity+ diamonds, the greater it reduces the value of these diamonds in relation to similar diamonds that exhibit no fluorescence. In colorless and flawless diamonds, the presence of strong fluorescence can reduce the diamond’s value by half.

The quality and accuracy of appraisals vary greatly depending on where you obtained the appraisal. This means that appraisal values are often inflated. From a comprehensive level, the retail appraisal value generally reflects the price it would cost your insurance company to replace your jewelry with a comparable new item. These figures are often higher than what a person actually paid.

Retail appraisals also heavily factor in the labor costs of producing and selling, the piece as well as the expense of retail markups. They are generally produced for insurance reasons and in most cases are at least 100% higher than wholesale values.

Liquid values represent your piece’s current pre-owned condition when you’re looking to sell a diamond. These values reflect what a diamond expert is willing to pay immediately for your jewelry. These values are based on the demand for this item on the secondary market and the actual value of the materials used. In most cases, original labor costs and retail markup are not factored into a liquid value appraisal. These values vary greatly depending on the accuracy of the evaluation, the financial position of the prospective buyer, their area of expertise, and the distribution channels they have access to.

When you’re looking to sell a diamond, it’s often natural to consider the value of a ring’s setting, in addition to the diamond itself. However, most people want the experience of selecting or designing their own engagement ring. This means that there’s not much demand for a used engagement ring setting. Many people presume that because an engagement ring setting is being sold, the relationship the item represents has ended. This also has led to a decreased demand within the market.

Consequently, this means that your setting’s values will largely come from the materials that were used in its construction. Like other luxury items, the majority of your setting’s initial cost reflected the time, labor, design, and retail markup associated with the formation of this ring. Much like how a wedding dress often costs thousands of dollars, yet it only contains a few hundred dollars worth of silk and other materials, the materials used to create the ring make up a small portion of the initial amount paid for the ring. Most diamond buyers purchase settings for the value of the materials used to create them. The precious metals and diamonds contained within an engagement ring setting will most likely be disassembled and the materials sold separately.

In the rare instance where a setting is sold “as is” to consumers, retailers often must drastically discount the used setting. Most ring settings are made of small diamonds which are less rare because they’re exponentially more plentiful and therefore less valuable. This means that even if your ring stays identical to the way it was when you purchased it, the value of the style will still decrease decidedly.

What’s The Difference Between A GIA Certified Diamond And Another Lab’s Certification?

The GIA is the gold standard when it comes to evaluating what a diamond is worth. This lab is trusted by industry experts to provide a clear, accurate, and unbiased analysis of a diamond. Unlike other laboratories which can often be biased, the presence of a GIA certificate can add thousands of dollars to the value of a diamond. Here is a breakdown of the difference between the GIA labs and other diamond laboratories

National Diamond Buyers Online Or In Person

When you’re looking to sell a diamond, a qualified, trustworthy buyer can mean the difference between a high offer and a positive experience or a misguided exchange. A good buyer will take every aspect of the diamond into consideration to make sure you receive the most when selling your diamond.

Diamond Banc is a national expert diamond buyer with offices throughout the United States. We take every value-adding factor into consideration to pay premium market prices for consumers’ diamonds. We offer immediate funding, fast and transparent communication, and provide a zero-pressure process. We even encourage our sellers to shop around for themselves. Our offers never expire, so we’ll honor any official offer we’ve provided after you’ve had the opportunity to look at other diamond buyers.

Our diamond buyers prioritize simplicity and transparency. These traits are especially significant due to the often opaque nature of the diamond industry. We will show you diamonds comparable to yours for sale on the largest dealer-to-dealer diamond trading platform and explain how we derive our purchase offer. Not only will we pay you for your primary diamond but also for the setting and accent diamonds. So instead of scouring the internet and searching “the best diamond ring buyers near me,” choose Diamond Banc.

We believe that honesty and directness are signs of respect. Our job is to explain to you the value of your diamond in the current marketplace and assist you in maximizing your return. If you wish to sell your diamond engagement ring, we will provide you with an immediate cash offer and fund the transaction within 24 hours.

Maximize Your Return: Diamond Sellers Agent Service

Entrusting us with your diamond places you in the capable hands of our dedicated seller’s agency. Our skilled team implements a dynamic marketing strategy, showcasing your diamond on multiple platforms to reach an extensive network of potential buyers, thus ensuring your diamond receives the broad exposure it needs to achieve its highest sale value.

We recognize that achieving a swift and successful sale while securing immediate payment stands as your top priority. Despite the allure of high returns touted by many consignment sellers, the reality can sometimes fall short, leaving many diamonds unsold and their owners uncompensated.

At Diamond Banc, we stand by the principle that actions outweigh promises. We’re committed to transparency and employ a forward-thinking strategy to market your diamond. By dedicating our resources and expertise, we aim to guarantee the successful sale of your diamond. Our goals are directly aligned with yours, assuring you of our dedication to securing the best possible return on your investment.

Choosing the right consignee is a critical decision that requires careful consideration beyond just the profit split. The ability of a consignee to fetch an attractive selling price and, crucially, to finalize a sale is paramount. The market is fraught with optimistic expectations that often lead to disillusionment due to unfulfilled sales.

Diamond Banc will gladly provide you with an immediate purchase price and consignment purchase price with any evaluation. Learn more about our Diamond Sellers Agent service.

Sell your diamond ring to Diamond Banc

Diamond Banc purchases a number of diamond and luxury jewelry pieces, including, certified and uncertified diamonds from 0.50ct and up. We will buy diamonds of any shape and therefore, we are the best platform for the resale of diamond jewelry. We also purchase fancy colored diamonds, and designer jewelry including signed pieces from David Yurman, Tiffany & Co., Cartier, Van Cleef & Arpels, Harry Winston, and more.

Start Online or Visit An Office Near You

OUR LOCATIONS

Miami, FL • Aventura, FL • Boca Raton, FL • West Palm Beach, FL • Sarasota, FL • Tampa, FL • Orlando, FL • Atlanta, GA • Nashville, TN • Columbia, MO • Kansas City, MO • St. Louis, MO • Scottsdale, AZ

Why work with us to sell your engagement ring or other diamond jewelry?

1. Kindness & Communication: Diamond Banc was created by a family of jewelers. We were built on the premise that clients should be treated with the same respect and enthusiasm when they wish to sell their diamond, as they received when they initially purchased it.

2. High Purchase Prices: Diamond Banc’s ownership group is composed of several of the largest independently owned diamond retailers in the country whose sales exceed $50 million annually. This unique advantage allows us to pay premium prices for your diamonds as we sell a significant amount back to the end consumer. In addition, our proprietary selling process includes national diamond dealer auctions and trading platforms. We know which buyers most appreciate which types of diamonds, allowing us to pay you the most. This comprehensive network also allows us to offer accurate and data-driven offers to make sure you’re getting the most out of your diamond.

3. Speed & Ease: You will find that Diamond Banc’s communication and speed of follow-up is unmatched by any other diamond buyer or online diamond buyer in the nation. We do what we say we will do, issue payment promptly, and provide maximum communication throughout the process. So choosing us after searching for diamond ring buyers near me is an ideal decision.

4. Safety & Integrity: Diamond Banc maintains an A+ rating with the BBB and believes the best way to thrive is to operate with the highest integrity and make our customers a top priority. From shipping to storage, Diamond Banc implements rigorous tracking and video recording procedures. We treat your valuable and treasured items as if they were our own.