Sometimes the unexpected occurs. When you’re in need of immediate financing, many people’s first thoughts are of using their 401Ks to borrow money. That money is just sitting there, right? Surely it can help. Wrong. Although the impulse to borrow from your 401K makes sense, it can come with a plethora of negative consequences. These disadvantages tend to significantly outweigh the benefits when borrowing against your 401k. Instead, take advantage of the equity you already have and use you fine jewelry or luxury watch to get a jewelry-backed loan from Diamond Banc.

Since the 2008 housing crisis, an increasing number of Americans are turning to their 401Ks as a loan source. Home equity loans are no longer an option for many people and personal loans are hard if not impossible to get. This leaving many people who need money for an emergency with few options. However, using your 401k to borrow money should be absolutely avoided.

Here’s why you should never borrow against your 401k:

1. It can set your further back in your retirement goals

. An estimated 22% of Americans only have $5,000 saved for their retirement. People are already under-saving for retirement. Borrowing against your 401K just compounds this problem. A 401K retirement fund allows the interest from your savings to compound over time. At a basic level, this is largely the point of a 401k. If you take the money out for a loan, this effectively prevents your compound interest from accruing.

2. Using your 401K to borrow money can cause your account to lose value

As you pay back the loan you’ll be re-buying the shares you previously sold, usually at a higher rate. Meaning that you lose much of the equity you have gained in your account.

3. Consider the fees that accompany borrowing from your 401k

Even if you are “just borrowing from yourself” there are fees associated with acquiring the loan, usually a processing fee that goes to the administrator.

4. Using your 401k to borrow money can mean you’ll have less savings in the long run

Depending on your 401K plan, you may lose the ability to contribute to the fund while you have an outstanding loan against it. Some loans may take years to pay back, which means years of no contributions from you or the match contribution from your employer. Since the best practice for retirement accounts is typically to save as much as you can as early as possible, given the role of compounding interest, this can have a snowball effect on your overall savings. Effectively cutting your savings down exponentially when you reach the age of retirement.

5. Borrowing from your 401k can mean lower wages when you need money most

Most 401K loan repayment plans require that payments to the loan be deducted automatically from your paycheck, so your take-home pay will decrease. Also the payment isn’t tax deferred, so you will be taxed on it. This means you can owe more than expected by the time taxes come due.

6. Taxes Taxes Taxes.

You’ll be taxed on the same money twice. You are repaying the loan with money that has been taxed and when you withdraw from your 401K during your retirement you’ll be taxed on it again.

7. Borrowing from your 401K can mean lower levels of security

If you quit or are fired from you job, you are required to repay the loan within 60 to 90 days, depending on your plan. If you are unable to pay the loan back during the repayment period, then the IRS considers the loan a distribution. The amount you borrowed is now subjected to income tax, as well as a 10% penalty if you are 59.5 years of age or younger.

Get a jewelry-backed loan instead of borrowing from your 401K.

Don’t fall prey to the trap of borrowing from your 401K when there are better alternatives. Using your jewelry as collateral to borrow money is a great way to keep your 401K intact, borrow money without negatively affecting your credit score, and get money quickly.

Diamond Banc specializes in providing loans to individuals who have fine diamond jewelry and engagement rings, high-end luxury watches and jewelry from top designers like Cartier, Bulgari, Tiffany & Co. and more. These items are used as collateral to secure the loan. The loan amount is determined by the liquid wholesale market value of the item. While the loan is in repayment, the item is stored in our secure vault. Once you have repaid the loan, we will return the item to you. If you default on the loan, we keep the item and sell it to recoup the amount you borrowed.

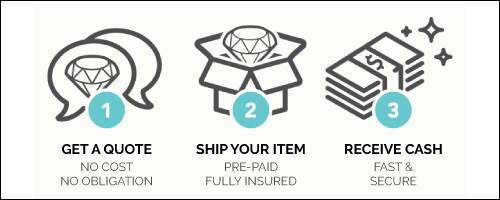

Diamond Banc’s unique loan process

Since the loan amount is determined by the liquid value of the item being pledged, we do not run any credit checks, employment verification or require a repayment guarantee. We also do not report the loan to a credit bureau; so it will not affect your credit score, even if you default on the loan.

The loan process with Diamond Banc is quick and easy. We can usually have funds in your account in as little as two days. Simply fill out a no risk, no obligation loan quote form on our website. Within 24 hours of receiving your submission we will send you our initial offer. Once the initial offer is agreed upon, we will send you a shipping label and instructions, or you can bring it into the location nearest you. When we receive your package we will verify your item. Once you accept our final offer and terms, we’ll wire transfer funds to your account or mail you a check immediately.

Visit the Diamond Banc website for more information and fill out one of our online forms. Or, visit one of our locations listed below.

- Boca Raton, FL

- Columbia, MO

- Kansas City, MO

- Miami, FL

- Nashville, TN

- Orlando, FL

- Palm Beach, FL

- Roswell, GA

- Tampa, FL